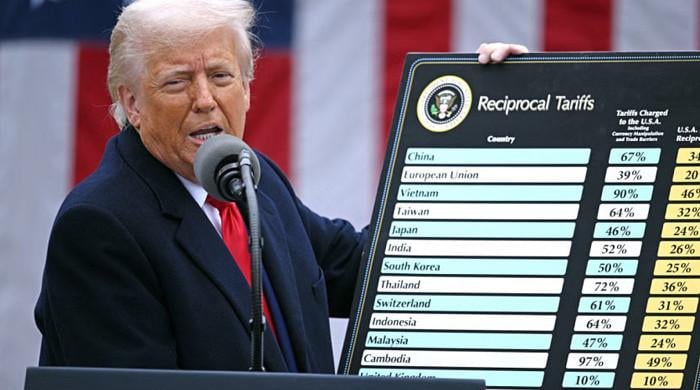

US President Donald Trump holds a chart as he delivers remarks on reciprocal tariffs during an event in the Rose Garden entitled "Make America Wealthy Again" at the White House in Washington, DC, on April 2, 2025. — AFP

#Trumps #tariffs #effect #Chinese #goods

The prices of US President Donald Trump’s dozens of economies came into force on Wednesday, including more than 100 % levies against Chinese goods, which dramatically promoted a devastating global trade war.

After the implementation of 10 percent prices in the weekend, after killing the global economy, exporters like the European Union or Japan on Wednesday increased imports on imports to the United States.

China – Washington’s largest economic rival, but also a major trading partner – is the most affected, when Trump returned to the White House, prices have been imposed on its products, which has now reached 104 percent of surprise.

Trump said Tuesday that his government was working with trade partners on “appropriate deals”, which the White House said would give priority to allies like Japan and South Korea.

His top trade official, Jameson Greer, also told the Senate that Argentina, Vietnam and Israel were among those who offered to reduce their rates.

Trump told dinner with fellow Republicans on Tuesday night that countries were “dying” for a deal.

“I am telling you, these countries are calling us to kiss our donkey,” he said.

But Beijing has shown no sign of standing, “by the end” to fight the trade war and promise to counter its interests.

On Thursday, China’s retaliation revenue is to be paid 34 % on US goods.

The US president believes that his policy will restore the US lost manufacturing base by forceing companies to move the United States.

But many business experts and economists ask that – if – sometimes – may be more inflation warnings because revenue increases prices.

Trump said Tuesday that the revenue in the United States states “has” about $ 2 billion a day “.

China ‘wants to contract’

It actually unveiled a 34 % extra tariff on sugar goods.

But when China confronted its own rates on US products, Trump piled up another 50 % duty.

The counting of the current Levies in February and March will increase the overall tariff for Chinese goods during Trump’s second presidency.

Trump has insisted that the ball is in a Chinese court, saying that Beijing “wants to make a bad deal, but he does not know how to start it.”

At the end of Tuesday, Trump also said that the United States would announce a largest rate “very soon” on pharmaceuticals.

Separately, Canada said some US auto imports will be implemented on Wednesday.

China ‘confidence’

In the last days, after ending the trillions of trillions globally globally, markets in Asia opened again on Wednesday, Hong Kong more than 3 % and Japan’s Nikki sank 2.7 %.

Foreign exchange markets were also observed, with South Korea fell to the bottom of the dollar since 2009 with South Korea.

China’s foreign yuan also declined against the US dollar, as Beijing’s central bank went on Wednesday to weaken the yuan because Bloomberg said it was the fifth consecutive day.

Oil prices have dropped, the western Texas intermediate closed for the first time after April 2021.

The European Union has tried to cool down tension, in which Block Chief Ursola Van Der Lane has warned against the damage of a trade dispute with Chinese Prime Minister Li Kiang.

He emphasized stability for the world’s economy, in addition to the need to avoid further increase.

The Chinese Prime Minister told Van Der Leene that his country could make a storm season, saying “is fully confident in maintaining a permanent and healthy economic development.”

The European Union – to which Trump has strongly criticized his tariff government – could unveil his response next week that he faces.

According to a document shown by the AFP, in retaliation against US Steel and Aluminum Levies, which was implemented last month, the European Union plans up to 25 percent on US goods from soybeans to motorcycles.

‘Derived deals’

Wall Street’s major index shut down on Tuesday, fell 1.6 % with a wide al -Qaeda S&P 500.

In a public indicator of friction at prices, key Trump Elon Musk has called White House senior trade adviser Peter Navaro “more dubber than brick sack”.

Musk, who has indicated his opposition to Trump’s trade policy, after Narrow called his Tesla company a “car collector” who wants a cheap foreign part.