#Factcheck #Canadas #Liberals #plan #capital #gains #tax #home #sales

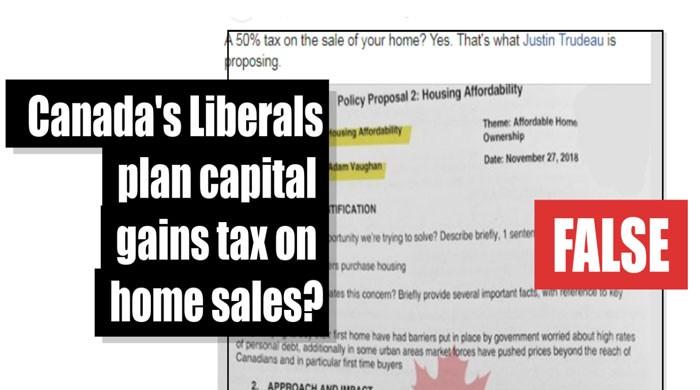

Dozens of social media posts claim the Liberal Party of Canada plans to tax sales of primary residences by up to 50 per cent if re-elected, with a Liberal MP proposing the policy as alleged evidence. Includes photo. This is misleading; The document, while genuine, is a town hall report that never became part of official policy. The Liberal plan, unveiled last week, focuses on loans for first-time buyers and not capital gains taxes on owner-occupiers.

50 percent tax on the sale of your home? Yes, that’s what Justin Trudeau is suggesting. The caption, along with an image of a page stamped with the Liberal Party of Canada logo, was shared more than 1,000 times. It outlines a policy proposal by Liberal MP Adam Vaughan from the central Canadian province of Ontario.

A Facebook page promoting the idea of a liberal tax on home sales was not alone in spreading the news. AFP Fact Check found at least 22 public posts that refer to the supposed tax, including several screenshots of a letter from Conservative Party of Canada (CPC) leader Andrew Scheer. Includes screenshots of a tweet warning about the Liberals’ housing plan. From CPC correspondent Candace Malcolm. CPC’s official Twitter account also shared an image of the policy proposal.

However, these posts do not reflect the reality of LPC’s housing policy. They’re based on a real document, but it’s a report from a consultation on housing policy produced by the party’s Ontario caucus in November 2018. It was presented by the Liberal candidate for Spadina Fort York, Adam Vaughan, who is also the government’s housing secretary.

“There’s no reality that anything more than what we heard at the town hall, that’s the beginning and the end of the conversation,” Vaughn told AFP of the proposal. Canada, 50 percent the first year, 25 percent after two years, 15 percent after three years, 10 percent after four years, and 5 percent after five years.

The leaked page was part of a wider report that compiled suggestions and ideas from the public heard at various events and town halls. “It wasn’t a recommendation, it wasn’t a policy proposal, it wasn’t even an idea that I support. But when you consult, you don’t just report things you like, you Report what you hear,” he added.

The Liberal Party’s current housing policy includes a first-time home buyer incentive, which has been implemented in the 2019 budget. The program allows first-time home buyers to apply to finance up to 10 percent of their home purchase through a joint equity mortgage, if they have a household income of less than Cad$120,000 and a home value of Cad$505,000. Not much.

The 2019 budget increased the tax-free retirement savings plan, registered retirement savings plan withdrawal limit from Cad$25,000 to Cad$35,000 for the purchase of a home.

On September 12, Liberal Party leader and current Prime Minister Justin Trudeau announced new housing proposals on the campaign trail in British Columbia’s west coast province of Victoria. These will expand the first-time home buyer incentive in the greater Toronto, Vancouver, and Victoria areas, where property values are high, by allowing homes priced up to Cad$789,000 to qualify.

The new plan also includes a national speculation and vacancy tax for non-Canadians who own homes in the country while living abroad. A one percent tax will apply to vacant homes owned by non-Canadians living abroad.

Neither official announcements nor policy documents from the Liberal Party include a tax on the sale of primary residences.

Under the current regime, no tax applies to the sale of a principal residence in Canada.

However, if a home was not a principal residence for each year that an individual owned it, the difference between the purchase price and the sale price is subject to tax. Half of this amount must be included in the individual’s income to be taxed, as with other capital gains taxes.