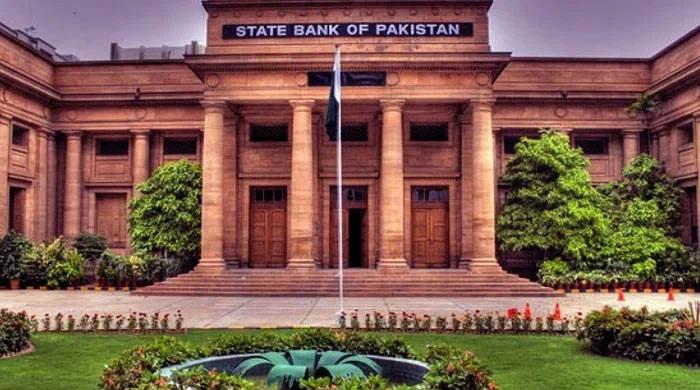

State Bank of Pakistan building. — AFP/File

#SBP #holds #interest #rate #geopolitical #risks #mount

KARACHI: The State Bank of Pakistan (SBP) on Monday kept its significant interest rate stable, and by choosing caution, the conflict between Israel and Iran increased the risk of inflation and the external sector.

The Central Bank’s Financial Policy Committee did not change the policy rate by 11 %, which was in line with the market expectations in view of Israel’s recent military attacks and their impact on international commodity markets.

In March, the Central Bank temporarily stopped its softening cycle after decreasing from 10 percent points to 10 percent points at a high rate of 22 percent in June 2024. In addition, it deducted another 100 points in May, making the key interest rate 11 %.

A Bloomberg report added that the majority of the 40 analysts surveyed by Bloomberg predicted the move. Several economists revised their forecasts in the days to reach the rate decision. The change in sentiment led to the promotion of tensions between Israel and Iran, which has raised a widespread conflict in the energy -rich region. The report states that for Pakistan – an economy that imports the majority of its fuel – any rise in oil prices can lead to a special setback.

Adnan Sami Sheikh, an analyst from the Pakistan Kuwait Investment Company, said the increase in oil prices increases the country’s annual import bill by about $ 1.5 billion and inflation by 1.0 percent.

The interest rate decision follows Pakistan’s annual budget, which targets 4.2 percent economic growth rate for the fiscal year 2026 and inflation at 7.5 percent. Additionally, it aims to reduce overall costs, increase defense spending and tighten tax measures.

According to Bloomberg Economics, SBP has only another capacity through only 50 BPS in the financial year 2026, based on our current predictions that inflation can be heated up to 8.0 % on average in 1H26. In 1h26, the neutral level is below 2.5 % of the real rates.

The MPC’s post meeting statement said that the economic growth is slowly increasing and it is likely to gain further pace next year, supporting the ongoing effects of deductions in the previous policy rate.

However, the committee noted the potential risks to the external sector, especially due to trade deficit and stabilizing weak financial influx. In addition, some proposed budget measures for the financial year 26 can increase the trade deficit by increasing imports. The committee also raised concerns about inflation associated with the increase in geographical political tensions.

Pointing to potential fluctuations, SBP is expected to fluctuate nearby inflation, before it gradually increases the target of 5-7 % and strengthened. SBP said, “However, this approach is subject to numerous threats posed by obstacles to the potential supply chain, the time and expansion of regional geographical political conflicts, oil fluctuations and other commodity prices, and the adjustment of domestic energy prices.”

In May, Pakistan’s inflation has increased due to the rise in food prices, which has changed the previous trend of moderation in the past few months. In the last month, the year -on -year -old inflation increased by 3.5 %.

“Although the Iran -Israeli conflict is at stake, oil prices may be suppressed due to weak demand and financial stability in modern economies. If the geopolitical stress decreases, we expect another 100bps rate reduction, which is likely to decline by 7.0 percent.”