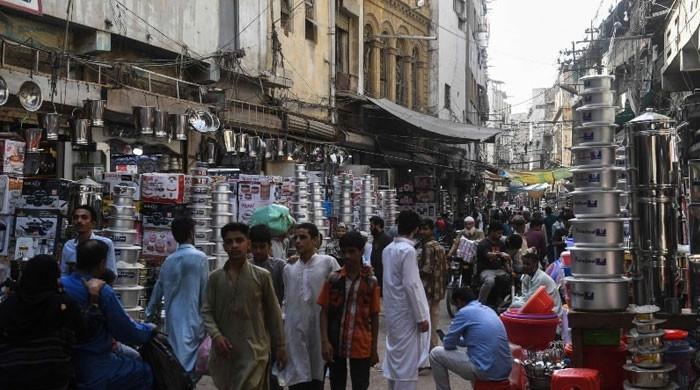

People shop at a market in Karachi. — AFP/File

#Unchecked #concessions #deepen #economic #woes

LAHORE: Pakistan’s current economic crisis is multifaceted, due to governance failures, global economic challenges and domestic incompetence. However, the situation has also been worsened by the continuous demands of the commercial and industrial sectors for economically unviable concessions.

The role of trade and industry in revenue leakage cannot be ignored. Many businesses oppose the documents for avoiding taxes and fueling the shadow economy. Smuggling and under-invoicing are common, with some sectors benefiting indirectly from these practices, leading to significant revenue loss for the state.

Instead of advocating for measures to improve governance and the business environment, trade associations often emphasize short-term benefits such as subsidies and tax holidays. While incentives such as lower taxes, energy subsidies and bailouts can sometimes be justified, they often strain fiscal resources when not linked to efficiency or structural reforms. These demands divert funds from critical sectors such as infrastructure, education and health care, further impeding sustainable development.

Trade and industry organizations have the leverage needed to push for meaningful reforms. By supporting documentation, complying with tax reforms and adopting technology, they can drive sustainable growth and increase competitiveness.

While the behavior of the private sector contributes to the crisis, the role of government is equally important. Weak institutional framework, poor governance and incompetence lead to corruption. With massive fiscal deficits, the state relies heavily on borrowing to balance the budget, leaving minimal resources for development. Political instability, global inflation and supply chain disruptions compound the economic woes.

A common vision is essential. The private sector should guide the government on reforms, adopt transparent practices and adhere to fair taxation. At the same time, the government must enforce accountability, address structural issues and build trust with stakeholders to establish a balanced and sustainable economic framework.

The private sectors of India, Bangladesh and Vietnam provide lessons for Pakistan. Businesses in these countries have historically emphasized long-term competitiveness, export growth and strategic cooperation with their governments rather than repeated demands for concessions.

In India, businesses have actively supported structural reforms such as the Goods and Services Tax (GST), recognizing its long-term benefits despite initial resistance. Collaboration initiatives like ‘Make in India’ have boosted export sectors, including IT, pharmaceuticals and manufacturing. Indian businesses have sought incentives linked to productivity or innovation rather than blanket exemptions and embraced transparency to secure international trade.

Bangladesh’s ready-made garments (RMG) sector has benefited from targeted government incentives such as duty-free raw material imports and tax holidays linked to export milestones. Instead of repeatedly pursuing unsustainable incentives, Bangladeshi businesses have focused on meeting efficiency, market access and export targets.

Vietnam’s private sector partnered with the government during the Doi Moi reforms, promoting foreign direct investment and export-led growth. In industries such as electronics and textiles, tax and land incentives are tied to efficiency, emphasizing global competition over short-term gains. Businesses prefer to meet international standards rather than lobby for temporary concessions.

In contrast, collaboration between the private sector and government in Pakistan often lacks the strategic focus seen in India, Bangladesh and Vietnam. To overcome its economic challenges, Pakistan should adopt a similar approach, emphasizing long-term growth, global competitiveness and sustainable economic practices.