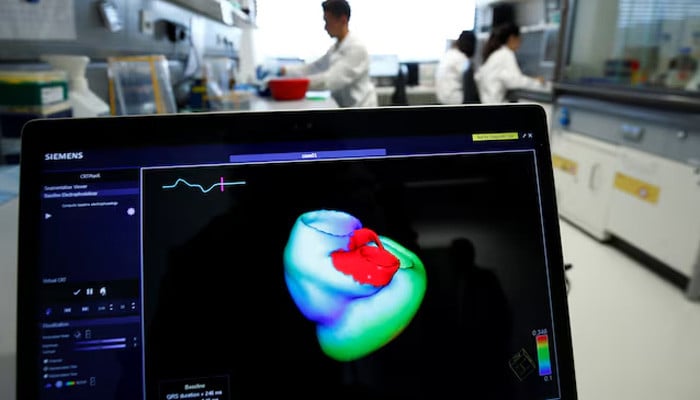

A partly-used, 10 gram bag of semaglutide powder made by China-based Sinopep-Allsino Biopharmaceutical, is pictured at a compounding pharmacy in Arlington, Virginia, US December 6, 2024. — Reuters

#Chinese #companies #turn #generics #shipments #weightloss #craze #fade

According to three sources, some Chinese companies now rally to create a general version of the Vegovy of Novo Nordsk, which provides components for more than one billion temporary foods sold online in the United States over the past two years.

Cheap copies of the zipbound zipbounds of Vegovo and Eli Lily are on the backdrop in the United States as regulators ban their sale, and slow down delivery by Chinese suppliers of raw components, which leads to explosive growth.

Robert Kaleyev, who had two stains to guide the US Food and Drug Administration, said that no new drug had never been so popular before that the manufacturer could not be easily maintained.

This shortage opened the door for compound pharmacies, which was charged by television firms that were flourished during the Covade pandemic, to provide cheap copies in a huge market, chasing the promised weight loss.

With the expiry of the patent in different countries, the FDA -approved genes is a year after the increasing demand for branded drugs, which is shown to help people reduce their weight by 20 %.

Sources told Reuters that at least eight Chinese companies, including Jiangsu Sinop-Allenso Bioferstical and High Beaver Pharmaceuticals, helped the United States flooding with raw semaglotide and tearzapatide, and the key to Vegovo, respectively. Reuters analysis about the US FDA shipping record is back.

According to sources of efforts about efforts and former Reuters reports, Hybio and Sinopop are working to launch their ordinary semaglotides. Sources also said that Nanjing Hanxin Pharmaceuticals and Fozian Genehopy Biotic, two companies that had provided compounds could also launch.

No company responded to comments requests.

The US law now bans compounding pharmacies for these patients for developing personal doses, or formulations offered by branded drugs.

The source of the Hibio and Sinopop’s efforts states that for a Chinese manufacturer, the supply of ingredients for low weight loss drugs is its largest business. He said the manufacturer is now targeting markets where Novo’s main semaglotide patent is expiring next year, such as Canada and Brazil, to sell these ingredients to drug makers.

He said he knows about at least five other Chinese companies that are known for providing compounding pharmacies, which are commonly refused to supply semuglotide.

Similar explosive growth is unlikely to produce. A lawyer for the lawyer for a common drugmaker said that his final, injection form preparations were complicated, which demanded not to disclose his name because he did not have the authority to discuss the subject.

Companies seeking to sell generic can also hit deals with branded companies that delay their market admission.

‘Once in a decade problem’

The demand for weight loss drugs while the supply of branded drugs was very low, it represented an unprecedented opportunity.

According to the FDA shipping data, in just 2024, eight Chinese companies sent enough raw materials to the United States to produce more than 1 billion starter foods for blockbuster medicine.

Novo’s estimate is even higher. It states that Chinese companies had sent a lot of smugglotide to the United States in just six months to make Vigo’s 1.5 billion starter food, according to a letter presented to the US Department of Trade and posted publicly.

In the first quarter of this year, there is no problem with the company’s supply shortage and the FDA is putting pressure on the elimination of mass compounding, hybioid, sinopup and others, taking a large batch of ingredients to copy both medicines.

By the second quarter, the ships declined by 90 % compared to a year ago, compared to a year ago, which was also an important component of Novo’s Diabetes Treatment Ozampic, and up to 34 % for tearpatide to make zipbounds and moonjaro copies.

Economics for Chinese companies that sell semaglotide to compounders. According to a 2024 report in Jama, the supply of semaglotide powder in a month costs only 7 cents. Chinese ingredient makers can sell it at least seven times more than the manufacturers who want to make copies, based on sales data provided by the source.

Injection in US compounding pharmacies was selling at an average of drugs and less than 230, which is more than half of branded prices.

Novo has cost high. It lost quarterly sales targets and shares of Danish drug makers this year have been reduced to half, which has helped the CEO to be expelled.

Records show that Sinopop, Hybio and another company have started shipping in the United States. Further larlylotide, an old novo drug, which is sold under the brand’s name under Victoza and Sexinda, which leads to a slight weight loss.

The generic versions of the Lerglotide available in the United States since 2024 have now been offered through online television sites, which once forwarded the semaglotide.

Another source, a wholesaler who sells obesity drug components for compounding pharmacies, but who did not have the option of publicly speaking, said he saw an increase in laerlotide sales.

The FDA, a senior fellow of the Brookings Institution, who is detecting the rise of the industry, said that the FDA’s shipment of Chinese -made semaglotide exploded shortly after announcing a shortage in 2022.

Calif said he expects companies to examine the ban on sale, and that the FDA will take the tone for the implementation of the industry. The FDA said it is committed to using all available tools to protect and monitor FDA -related products.

Nevertheless, Kalev said, having a mixture of weight loss medicines on a high -scale is probably “a problem in a decade.”