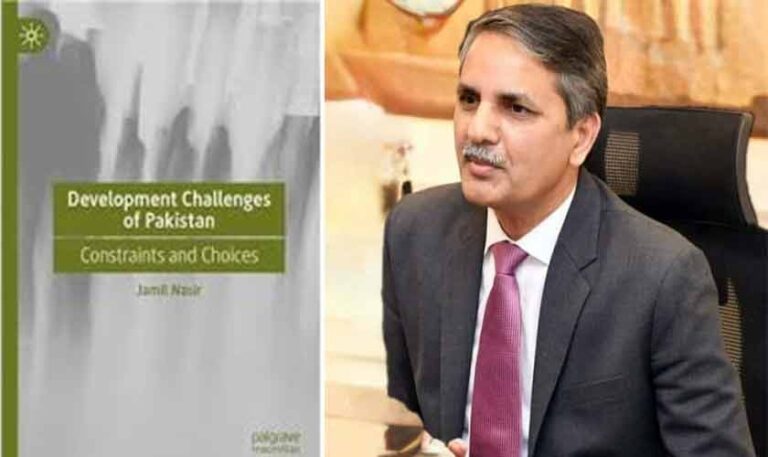

State Bank of Pakistan Governor Jameel Ahmad speaks at the Reuters NEXT Asia summit in Singapore July 9, 2025. — Reuters

#Pakistan #launch #digital #currency #pilot

State Bank of Pakistan (SBP) Governor Jamil Ahmed said on Wednesday that the Central Bank is preparing to launch a pilot for digital currency and is in the final stages of preparation for legislation to manage virtual assets.

The move came when Islamabad promoted efforts to modernize its financial system during the growing global interest in blockchain payments, with central banks around the world seeking the use of digital currencies.

Similar steps were taken to test or release digital currencies through controlled pilot programs after China, India, Nigeria, and several Gulf states for digital currency.

While attending Reuters at the next Asia Summit in Singapore, Ahmed said that Pakistan “Central Bank is increasing our capacity on digital currency” and hopefully a pilot will be ready soon.

He was talking on a panel along with P. Nandle Versinghi, the governor of the central bank of the Central Bank of Sri Lanka, both discussed financial policy challenges in South Asia.

Ahmed said a new law would “lay the foundation of licensing and regulations of the virtual assets sector” and the central bank was in touch with some tech partners.

The move has promoted the efforts of the government -backed Pakistan Crypto Council, which was established in March to adopt virtual assets. PCC is looking for BitCoin mining using surplus energy, appointed Binanus founder Changping Xiao as a strategic advisor and plans to establish an officially -operated bitcoin reserve.

It has also discussed with the United States -based crypto firms, including the global Liberty Financial Financial, associated with Trump.

In May, the State Bank of Pakistan made it clear that virtual assets were not illegal. However, he advised financial institutions not to engage with them until a formal licensing framework is available.

“There are risks associated with it, and at the same time, there are opportunities in this new emerging field,” he said on the panel. So we have to carefully review and manage the risk, and do not allow the opportunity to give the opportunity at the same time. “

On Wednesday, Pakistan’s Minister for Blockchain and Crypto said in a statement that the Pakistani government had approved the “Virtual Asset Act, 2025”, which has constituted an independent regulator to grant and monitor the crypto sector.

‘Strictly Monetary Policy Transfer’

Ahmed said the central bank will maintain a strict policy stand to stabilize inflation in its 5-7 % medium -term target.

Pakistan has reduced its benchmark rate from 22 % to 11 % in the last one year, as in May 2023 reduced from 38 percent to 3.2 percent in June, which is an average of 4.5 percent in 2025 fiscal year, the lowest level in nine years.

“Now we are now looking at the results of this strict monetary policy transfer, both inflation as well as in the external account,” he said.

Ahmed said that Pakistan did not face the dollar weakness, its foreign debt was mostly affected by the dollar and only 13 % consisted of Eurobond or trade loans.

“We do not see any major impact,” he said, adding that the reserves two years ago have dropped from $ 3 billion to $ 14.5 billion.

Ahmed said that Pakistan’s three -year -old IMF program, which continues until September 2027, was on track and has resulted in financial policy, energy prices and foreign exchange market reforms.

“We believe that after this (IMF program), we will probably not need to follow up.”

Asked whether the purchase of Pakistan’s upcoming military equipment, especially the imports of imports from China, said the governor of the Central Bank of Pakistan said he was not aware of such projects.