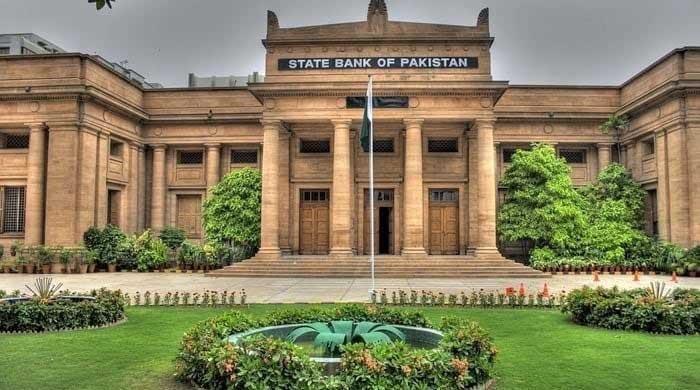

In this picture, the State Bank of Pakistan building in Karachi can be seen. — SBP/website

#SBP #holds #rate #steady #Middle #East #crisis #flares

The State Bank of Pakistan (SBP) has not changed the policy rate by 11 %, citing rising external threats and inflation pressure, Iran is linked to Israel’s intense conflict.

The decision was deducted by the Monetary Policy Committee (MPC) last month as the central bank weighs economic stability against the growing global pressure.

The Middle East found on Friday in a dangerous new chapter of the war, following an extraordinary increase in hostility between Israel and Iran.

In the darkness of the night, the Israeli strike on Iran’s top military and nuclear figures rapidly increased in a complete conflict, with both sides threatening heavy exchange and regional stability.

In its final meeting on May 5, the SBP reduced the interest rate by 100 points (BPS) to 11 %, mainly due to stable disinfectious disinfection. The central bank has reduced the rate by 22 % to 1,100 twenty points since June.

According to the MPC statement, “At its meeting today (Monday), the committee has decided to change the policy rate by 11 percent,” according to the MPC statement.

The MPC said that the rise in inflation in May (Y/Y) was expected to be expected, while basic inflation has decreased significantly.

“Going forward, inflation is expected that the target limit will be trended and stabilized during the financial year 26,” the statement said.

The MPC also noted that the economic growth is slowly recovering and it is expected that the impact behind the decline in the previous policy rate next year will achieve further pace.

“At the same time, the committee mentioned some potential threats to the external sector between the trade deficit and the permanent width of the weakening financial arrival.

According to the statement, “Further, some of the fiscal year 26 budget measures can further expand the trade deficit by increasing imports. In this regard, the committee considered today’s decision to maintain economic and cost stability.”

MPC also cited the following predictions:

“First, the actual growth of GDP for the financial year 25 is temporarily reported 2.7 percent, and the government is targeting a 4.2 percent increase for next year.

“Second, despite the trade deficit, the current account in April remained widely balanced.

“Meanwhile, the completion of the first EFF review resulted in about $ 1 billion, which increased the SBPKFX reserves by $ 11.7 billion by June 6.

“Third, the revised budget estimate gives the basic balance addition to 2.2 % of GDP in fiscal year 25, which is more than 0.9 percent last year. For next year, the government is targeting 2.4 percent of the GDP’s high basic addition.

Read the statement, “Finally, global oil prices have begun to recover rapidly, which reflects the geographical political situation in the Middle East and some ease in China’s trade tension.”

The MPC estimates that the real interest rate is properly positive to stabilize inflation in the target range of 5 – 7 %.

The statement emphasized, “In addition, the committee called for timely understanding of planned foreign arrival, targeting financial stability and the implementation of structural reforms to maintain economic stability and sustainable economic growth.”

Inflation predicted

The preliminary diagnosis of the MPC indicates that recent budget measures have a limited impact on inflation.

However, some near-term fluctuations in inflation are expected before it is slowly inch and 5-7 % stabilizes the target limit.

However, this approach is subject to numerous risks posed by barriers to supply chain from regional

Geo -political disputes, oil volatility and other commodity prices, and adjustment time and expansion in domestic energy prices.

Marketbag

A Reuters survey on Monday showed that the central bank’s policy rate is expected to be implemented, as many analysts have changed their previous ideology in the context of Israel’s military strike on Iran, which cited rising prices of global commodities.

Israel said on Friday that it targeted nuclear facilities, ballistic missile factories and military commanders in the “prepaid strike” to prevent Tehran from making nuclear weapons.

Several brokerage was initially expected to cut after raising concerns over the widespread Israeli strike conflict, but revised their predictions.

Increasing enmity gave rise to a sharp rise in oil prices – possibly prolonged conflict and tightening of crude goods due to the widespread impact on import inflation.

The policy meeting is after the release of a tough annual budget, which has seen that Pakistan has increased defense spending by 20 %, but the forecast of GDP growth has decreased by 4.2 %, the overall cost has decreased by 7 %.

The government says the country’s billion 350 billion economy has been strengthened under an IMF bailout of $ 7 billion, which has helped prevent the pre -default threat.

Some analysts doubt the government’s ability to reach the target of development between financial and external challenges.