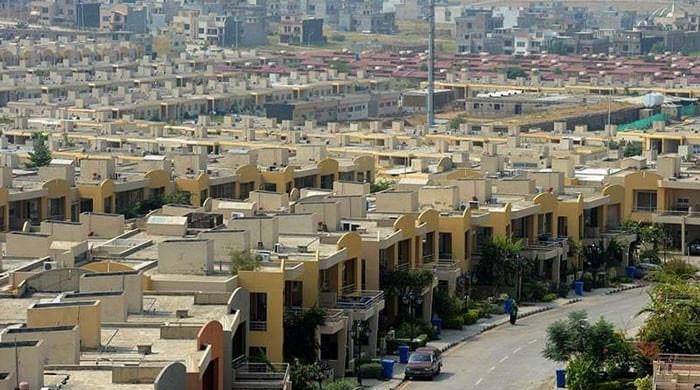

A general view of a neighborhood in Pakistan. — AFP/File

#government #deliver #affordable #houses #Experts #weigh

KARACHI: Pakistan’s new budget aims to promote real estate sector with focus at affordable housing, but explaining the shortage of accommodation on the next low -cost residential scheme.

Shahbaz Sharif government has announced a set of privileges for the property sector in Budget FY 26. This includes subsidy of Rs 10 billion for the housing sector. In particular, Rs 5 billion has been allocated directly to support housing, while another Rs 5 billion has been allocated for markup subsidy on low -cost housing. The move aims to build 200,000 houses for the lower and middle -income sections of society.

Policy makers are focused on expanding access to mortgage financing. Therefore, they have introduced a proportional tax credit on the loans obtained for the construction and acquisition of flats up to 250 square yards and up to 2,000 square feet. In addition, the government plans to eliminate the Federal Excise Duty (Fed) by 7.0 % and reduce the advance tax from 150 points (BPS) on the purchase of immovable property. However, advance tax on immovable property sales will increase by 150bps.

Starting next month with next month, home, builders and real estate markets are looking forward to introducing a framework for the low -cost residential scheme’s Rollout and mortgage financing.

“Funds allocated under housing subsidy in the fiscal year 26 budget can support the construction of more than 40,000 homes if it is used effectively,” said Evas Ashraf, director of AKD Securities Limited.

Pakistan’s residential crisis is increasing due to the rapid population rise, citizenship and a significant decline in people’s purchase power. A report by the House Building Finance Co., Ltd., indicates that housing is usually considered cheap if it does not cost more than 30 % of the total revenue of the house, including rent or mortgage payment and necessary utility.

Currently, many families in Pakistan face relatively high accommodation costs, which has little room for savings. Even despite low interest rates, more property prices than income can make home ownership for many Pakistanis.

Ashraf added, “The IMF is against indirect subsidy, not directly subsidy, while the increasing room will make room for these subsidies due to a strong increase in tax revenue and a reduction in interest costs.”

But will the government plans make a lot of difference in reality? Or can they cause the same problems that led to the sudden suspension of the ‘My Pakistan My Home’ program in 2022, after pressure from the International Monetary Fund (IMF) subsidy reduction?

Dr. Anush Ahmed, a US -based real estate investor, believes that the budget provides direct and indirect support to the entire property environmental system. Housing subsidy of Rs 5 billion will help those who benefit from the New Pakistan Housing Scheme, while the restored tax credit on mortgage facilities will facilitate long -term loans for middle -income households.

Ahmed said, “Eliminating excise duty and low holding taxes will reduce the cost of buying and selling property.” He added, “These measures will increase the confidence between both the developers and the closing consumers, accelerate the construction activity, and the pace of the property will be improved. All this is good for the economy and for the families of their future hope.”

“By reducing the cost of transactions in the market and increasing the liquidity, the government is taking a meaningful step towards forming and measuring the landscape of Pakistan’s property. This is a bold and necessary step in an important time.”

However, Ahmed says it needs to be ensured that the recent restrictions on non -filers can stop the flow of investment, especially with Pakistanis abroad who cannot yet be integrated into the local tax system.

He praises a clear road map for financial discipline and growth shown in the budget. This is a good time to move forward with accommodation and infrastructure projects, with the cost of reducing business and the government’s policy direction.

JS Investment Limited Chief Investment Officer Syed Hussain Haider says relief measures in the fiscal year 26 signal intentions, especially removal of feed and restoration of mortgage tax credit. However, the package lacks harmony and is less than a wider strategic framework.

Haider said, “There is a clear absence of support for making this sector an institution. For example, an important capacity for forming a formal capital in real estate, no progress has been made on extension of capital gain tax exemption under Article 99A for Reits.”

“Continuous greed in the policy has been a major obstacle to long -term development,” he said. In addition, like 5 billion residential subsidies allocate token, despite the severe cutting power power, he said.

He added, “What is truly needed is a comprehensive economic overview that allows for an example in the social sector to take root of equity, justice and ability, because in the end, everything is deeply integrated.”

According to Haider, these measures announced in the budget usually improve the dynamics and cheapness of the transaction, especially at the bottom. Reconciliation of mortgage tax credit and housing subsidy can encourage the maintenance channels to maintain formal financing channels. However, the support measure is limited. They believe that without complementary structural improvements, especially to deepen reit markets and stimulate documentary activity, the real potential of this sector will be unbearable.

Experts noted that although there is no separate policy that aims to fully attract foreign investors to immovable property, budget reforms indicate opportunities for Pakistanis and international stakeholders abroad. Improved transaction tax rationality and implementation of documents can increase transparency, which is an important factor in attracting institutional capital.